Food Nutrition 2019

About Conference

EuroSciCon organizes the 23rd Edition of International Conference on Food Nutrition & Beverages during September 25-26, 2019, PCopenhagen, Denmark with a theme “New Era-New Directions to Food & Nutrition Research”. Participating at Food Nutrition 2019 this pinnacle will bring organized the senior level specialists with a perfect blend for multidisciplinary collaboration between innovators, scientists, academicians from all over the world and discussed the newest innovations with keynotes and featured presentations in the field of food and nutritional research.

Food Nutrition Conference is a two days meeting comprises workshops, symposiums and special keynote sessions led by famous and prestigious speakers who exceed expectations in the field of Food and Nutrition. This food and nutrition Conferences as well encourages the active participation of young students, and talented understudy bunches from universities and research labs giving an ideal space to share the latest progressions in the Nutrition and Food Investigate and upcoming analysts and sprouting researchers as we are allowing Poster Award Competition and Young Research Forum at the meeting venue.

Importance and Scope:

Food and Nutrition conferences aims to bring together leading academic Scientists, Researchers, Doctors Professors, Research fellows, Directors, Deans, Post-graduates in Nutrition and food, Food and nutrition Professionals, Health Care Professionals, Nutrition, Food Specialists , Nutrition Entrepreneurs, Nutrition Faculty, food Faculty, Nutrition Academicians, Food and nutrition Academicians, Students and Business Delegates to exchange and share their experiences and research results about all aspects of Food and Nutriton Management.

We have dealt with several productive Nutrition occasions and Nutrition meetings which formed incredible relations, bringing the experts Food: acrylamide is formed in the Maillard reaction and associations together. Nutrition Meetings, Nutrition Conferences and Food and Nutrition Events are basic for the common citizens to remain strong and fit for the length of their life. Food and Nutrition conferences, Nutrition events and Food and Nutrition meetings are very important in relations of the research that are successful on worldwide, so that the Knowledge can spread to continue fit and healthy throughout our life.

Why Copenhagen?

Copenhagen is the capital and greatest populous city of Denmark. The city has a population of 763,908 (as of December 2016); of whom 601,448 live in the City of Copenhagen. The larger urban area has a population of around 1.3 million (as of 1 January 2016), while the Copenhagen metropolitan area has just over 2 million inhabitants. Participation rates stayed between 78% and 87% in the three programmers. Standardized mortality rates (SMR) were designed in relation to mortality rates in the city of Copenhagen and in the whole country in three age groups and the two genders.

Copenhagen is home toward the University of Copenhagen, the Technical University of Denmark and Copenhagen Business School. The University of Copenhagen, initiated in 1479, is the oldest university in Denmark. Copenhagen is home toward the FC København and Brand by football clubs. The annual Copenhagen Marathon was established in 1980 Copenhagen is one of the greatest bicycle-friendly cities in the world the Copenhagen Metro launched in 2002 serves central Copenhagen though the Copenhagen S-train network helps and connects central Copenhagen to hers outlying boroughs. Helping roughly two million passengers a month, Copenhagen Airport, Kastrup, is the fullest airport in the Nordic countries.

Who should attend?

-

Professors

-

Food & Nutrition Experts

-

Dietitian Nutrionists

-

Nutrition Science Researchers

-

Policy makers

-

Health care providers

-

Industry Renders

Opportunities for Conference Attendees

For Researchers &Faculty:

Speaker Presentations

Poster Display

Symposium hosting

Workshop organizing

For Universities, Associations & Societies:

Association Partnering

Collaboration proposals

Academic Partnering

Group Participation

For Students & Research Scholars:

Poster Competition (Winner will get Best Poster Award)

Young Researcher Forum (YRF Award to the best presenter)

Student Attendee

Group registrations

For Business Delegates:

Speaker Presentations

Symposium hosting

Book Launch event

Networking opportunities

Audience participation

For Companies:

Exhibitor and Vendor booths

Sponsorships opportunities

Product launch

Workshop organizing

Scientific Partnering

Marketing and Networking with clients

Market Analysis

Market Analysis

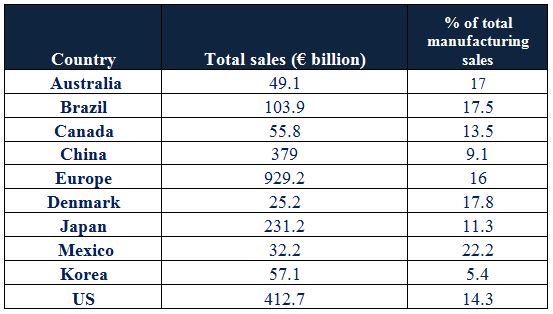

The food and drink industry is the largest manufacturing sector in the EU in terms of turnover, value added and employment. It is the second leading manufacturing sector in terms of number of company. Denmark, Germany, France, Italy, UK and Spain are the largest EU food and drink producers. Every year, the EU food and drink industry export products worth around €65.3 billion.

Global Market:

The global Food and Beverages market is expected to grow over $250.43 billion by 2022 at a single digit CAGR through the forecast period. Each aspect of food technology market is blooming. The Food and Beverages Technology is growing globally at 3.5% a year and is expected to grow more than USD 7 trillion by 2014. Key trends for new product development are in health, convenience, naturalist and sustainability. New fruits and vegetables based foods fulfil the demands of the premium consumer. The functional foods (foods that offer benefits beyond basic nutrition) market is one of the fastest growing segments of the global food industry. Around US$25 billion of global sales is achieved by foods and beverages that offer validated health claims, he wider functional food market, including rehydration and sports drinks and foods with softer health claims, is estimated to be worth around US$200 billion.

USA:

Food processing in the U.S. has come a long way since the 1900s. Companies started developing products that have longer shelf life and were easy to carry. As investors saw the opportunity in processed foods more and more companies entered the market which not only created jobs but also led to a rise of the American food manufacturing industry around the world. Presently, Coke is distributed in more than 200 countries making the product a global icon. Similarly, Mars Inc., which started out as a candy manufacturer, now has departments looking after pet care, biotech, and Food and Beverage, distributing its products internationally. ConAgra Foods has 29 brands which bring in annual retail sales of $100 million each. Thus these companies are dominating the international market. Companies provide much needed jobs to communities. More than 1.5 million people are currently employed by food manufacturing firms in America.

In Kentucky, logistics has become the major attraction for companies. In Ohio, the low tax structure acts as an attraction for food companies. Pennsylvania’s Lehigh Valley has the highest number of Beverage manufacturers. The U.S. food industry will have a steady growth of 2.9% CAGR through 2022. In the future the processed foods industry gives economic developers more opportunities to create jobs and attract projects.

Europe:

The major manufacturing hubs in the globe are Europe which constitutes the majority share in the food flavour’s and enhancer market along with North America. European market is a mature market and has several regulatory bodies to regulate stringently the use of food flavours and enhancers, thereby taking care of the consumers of the nations. Germany constitutes the major share having 24% followed by the UK (23%), Spain (10%), Netherland (5%) and Italy (9%). US $ 823 million is the market size by value of the synthetic flavour and $ 755.65 million US dollar is the market size by value of the natural in the year 2014.

Asia-Pacific:

The Asia-Pacific food market is constantly growing. China is the one of largest food markets in volume and value terms because of its population size and growing income. The preservative market in Asia-Pacific is diverse; developed countries (e.g., South Korea and Japan) account for 40% of the market and consume non-genetically modified (GM)-based antioxidants, while developing countries (e.g., Singapore, Malaysia, Thailand, Taiwan, and Vietnam) consuming more GM-based antioxidants. The fortified food ingredients are key growth drivers in Asia Pacific.

Asia turns to be the home to the world’s fastest growing retail markets for processed meat, poultry and fish, with Indonesia and India playing key roles across these categories. With a CAGR of 26.7% between 2011 and 2015, Indonesia is currently among the fastest growing processed meat and poultry markets globally, followed by India (22%), Vietnam (15.5%), China (13.9%), and Brazil (10.9%). Asia Pacific was the second most dynamic section globally in terms of processed meat, poultry and fish New Product Development (NPD), accounting for 24% of processed meat, poultry and fish product innovations, led by China, Thailand, South Korea, Vietnam and the Philippines in 2016. In the Asia-Pacific region, poultry meat includes the mainstream of the demand. The per capita consumption of poultry meat is expected to reach 39.6 kg in Australia by 2022.

Irelands:

Ireland’s food sector remains in robust health, with the foodservice market growing to a record $8.69 billion in 2016 and forecast to grow to more than $10.43 billion by 2020. Ireland supplies 41 per cent of food and drink exports to the UK, valued at $ 5.10 billion. This comprises: 70 per cent of prepared consumer foods exports; 56 per cent of meat exports; 30 per cent of dairy exports (including 60 per cent of cheese exports); and 32 per cent of alcohol exports. With the level of tariffs that could apply under the WTO, the impact on trade, competitiveness, company profits and farm incomes would be catastrophic.

Major Producers in Denmark

In Denmark, the organic food sector is dominated by Danish and Danish companies jointly owned by international investors, producing a range of organic products. The major producers and wholesale dealers in Denmark include:

- Arla Foods producing dairy products.

- Friland A/S producing meat based products.

- Urtekram producing cereal based products.

- Hanegal Økologisk Kød A/S producing meat based products.

- Coop Danmark A/S leading consumer goods retailer.

- Thise Mejeri is producing dairy products.

- Agrova Food (DLG) producing feedstuff.

- SuperGros A/S is the largest wholesaler in the grocery retail market.

- DANÆG Products A/S producing egg based products.

- Hørkram Schultz Food Service A/S supplier of foodstuffs for professional catering centres

1. Market and Sector Challenges (Strengths and Weaknesses)

1.1 Consumer behavior

Denmark has one of the world’s highest per capita rates of consumption of organic foods. Studies have found that half of the Danish population buys organic products. In Denmark, the purchase of organic foods has moved from the luxury goods segment towards mainstream consumption. This is one of the reasons that the organic market has not been affected by the financial crises.

Even though half of Denmark’s citizens buy organic products, there is a continuing segmentation in the market, with the presence of specific segments of organic consumers. It is mostly people living in the capital, families with one child, in the age of 30-39 years, and those with high incomes and advanced levels of education who buy organic products.

Among Danish consumers, there are two main drivers for the consumption of organic products. Some consumers seek out organic food out of a concern for higher quality of for ethical reasons, including a focus on the environment and ecological concerns, animal welfare, and their own health. Another reason for buying organic products is the fact that the products are relatively cheap and readily available.

1.2 Expected growth of the organic sector

Today, Denmark has an efficient market for the manufacture and sale of organic products. Organic food production is growing and is expected to increase in the future in terms of Danish production, consumption, and export. The Government in Denmark has maintained focus on ecology and organic food, with a goal of doubling the ecological sector of the economy. Today, the Danish government is focusing on concrete initiatives to reach the production goal and to develop sales through the major retail chains.

1.3 Trade policies

As a member of the European Union, Denmark follows EU practices of imports of organic products. EU regulations for the export of organic products into other EU member states changed in 2009.In short, the major change is that the product that is exported should be approved in the country of origin by a controlling agency that has been approved by the European Commission. Throughout 2012, this regulation will run parallel with the old regulation that stipulates that the importer needs permission from the competent authority in the country (i.e. the National Food Agency in Denmark – Fødevarestyrelsen). The European Union and Canada are negotiating a free trade agreement that would further simplify the process of exporting Canadian organic food to European member states.

1.4 Controlling organizations of organic products in Denmark

The most well recognized common organic label in Denmark is the red ‘Ø-label’ (the left label below). According to surveys, 98 percent of the Danish population recognizes the Ø-label and 90 percent place great deal of trust in the Ø-label. The label was introduced in 1989 and is maintained by the government. The Danish state and the retail chains have both heavily promoted the label during the first part of the 1990s.

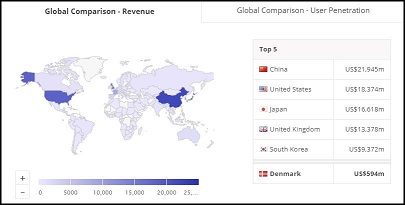

Global Market Revenue:

- Revenue in the Food & Beverages segment amounts to US$594m in 2019.

- Revenue is expected to show an annual growth rate (CAGR 2019-2023) of 10.7%, resulting in a market volume of US$893m by 2023.

- User penetration is 13.9% in 2019 and is expected to hit 16.4% by 2023.

- The average revenue per user (ARPU) currently amounts to US$738.38.

- In global comparison, most revenue is generated in China (US$21,945m in 2019).

EU Food and Beverages industry

Turnover €965.2 billion

Largest manufacturing sector in the EU (16.0%)

Employment 4.1 million people

Leading employer in the EU manufacturing sector (14.6%)

R&D (% of food and drink output)

0.38%

SMEs

48.7% of food and drink turnover

63.0% of food and drink employment

External trade

Exports €65.3 billion (+21.5% compared to 2009)

Imports €55.5 billion (+9.3% compared to 2009)

Trade balance €9.8 billion

Number of companies

274,000 Fragmented industries

EU market share in global exports

17.8%

Consumption (% of household expenditure)

13% Stable

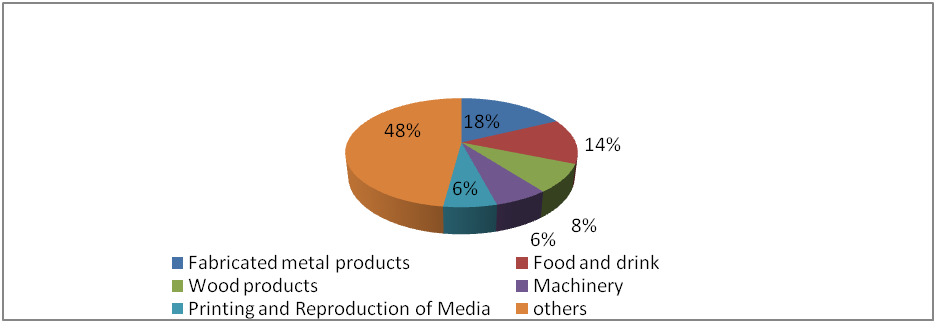

Food and Beverages industry in EU manufacturing Sector

Food and drink industry worldwide

Global value of Food and Beverage market:

- Value of global F&B industry

US$5.7 trillion

- Top producers of food and beverage products

Europe, USA

- Companies with revenues more than US$50 billion

Nestle SA, Archer-Daniels Midland, Unilever NV, Bunge Ltd

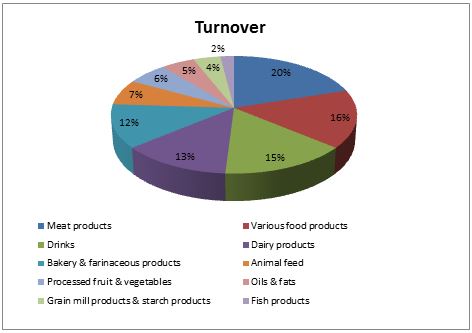

Distribution of Turnover sector of the Food and Beverages industry according to product

Projection: Growth of Food & Beverages sector for upcoming years:

Meat consumption worldwide has doubled in the last 20 years, and it is expected to double again by 2050.

The global food and beverage industry is growing at 3.5% a year and is expected to be worth more than US$7 trillion by 2016.

Foods and beverages that offer validated health claims account for around US$25 billion of global sales, mainly in the key markets of Japan, the USA and Europe. Levels of food and drink waste by commercial and industrial businesses in the food sector were almost halved down 49%.

The food sector (excluding agriculture) is showing resilience to the economic downturn with an increase of 6.3%. There was a rise of 7.4% in food wholesaling, 4.7% in food manufacturing and 14.6% in non-residential catering. Food retailing changed little at 0.4%.

Longer term, the food sector (excluding agriculture) increased by 48% between while the whole economy increased by 61%. The food sector has less scope for growth as there is a limit to consumer intake capacity and therefore it relies largely on quality improvements.

This report is targeted at the existing players in the industry, which include the following:

• Research organizations

• Food manufacturers, suppliers, distributors, and retailers

• Food & beverage producers, suppliers, distributors, and retailers

• Food Technology equipment manufacturers, traders, distributors, and dealers

The study reveals several questions for stakeholders, which market segments to focus on in the next two to five years for prioritizing efforts and investments.

Worldwide Food and Beverages Industries

• Cargill

• Nestle

• Archer Daniels Midland

• PepsiCo Inc.

• Kraft Foods Inc.

• The Coca-Cola Company

• Anheuser-Busch InBev

• Tyson Foods Inc.

• Unilever Plc/Unilever NV

• Mars Inc.

• SABMiller Plc

• Kirin Brewery Company Ltd

• Heineken N.V.

• Lactalis

• Asahi Breweries Ltd.

• Associated British Food

• Diageo Plc

• Fonterra

• General Mills Inc.

• Kellogg Company

• FrieslandCampina NV

Sessions and Tracks

Track 01: Food Science and Biotechnology

The blend of Food Science and Biotechnology is quite unique, as well as complex and intriguing. Biotechnology is vast, without boundaries, and offers great possibilities as well as concerns, for ten thousand years fermentation, a form of biotechnology has been used to produce wine, beer and bread. The respective session of this Food Conference will focus on how food Science and Biotechnology contributes to the science of making better foods on a daily basis.

Recommended Conferences: Food and Beverage Conferences | Food Conferences | Food Technology Conferences | Food Agro Processing Conferences

Related Conferences:

23rd Edition of International Conference on Food Nutrition & Beverages, September 25-26, 2019, Copenhagen, Denmark; 10th Euro-Glo

Learn more

Food and Nutrition Universities

Europe:

Leeds Beckett University | University of Surrey | University of Roehampton | University of Nottingham | Liverpool John Moores University | Edge Hill University | Imperial College | University of Aberdeen | University of Bedfordshire | Northumbria University | Sports Nutrition Conferences | The University of Leeds | University of Navarra | University of Barcelona | University of Wolver Hampton | University of Miami | University of Canterbury | University of Basel | The Open University | Wageningen University | University of Calgary | University of Toronto | Lund University | Tufts University | University of Adelaide | University of Lowa | Nutrification Conferences | University of Amsterdam | University of Hertfordshire | University of Helsinkiaterloo | University of Sydney | University of Florida | University of Wollongong | University of Vienna | | Food Packaging Conferences | Brown University | Coventry University | University of Huddersfield | Stockholm University | University of Auckland | University of Zurich | Concordia University | Queens University | Food Technology Conferences | University of Minnesota | Teesside University | Food Microbiology Conferences | University of Brighton | University of Gothenburg | University of Washington | University of Otego | University of Debrecen | Tilburg University | University of Bergen | York University | Aalto University | Lough borough University | Master University | Food Security Conferences | Harvard University | Macquarie University | University of Glasgow | University of Aberdeen | University of Limerick | University of Cambria | University of Illinois | Florida International University | Western Sydney University | Trine University | The University of New Mexico | James Madison University | Okan University | Baylor University | Van Hall Larenstein | University of Applied Sciences | Food Safety and Microbiology Conferences | The University of Vermont | CQ University Australia | Glasgow Caledonian University | University of Tasmania | James Madison University | James Madison University | Taylor's University | Louisiana State University | Louisiana State University | Food Safety Conferences | Florida International University | University of Saint Joseph | Bath Spa University | Lipscomb University | West Virginia University | Long Island University | Springfield College | Izmir University of Economics | Washington State University | Colorado State University | York Saint John University | London South Bank University | Liverpool John Moores University | University of Westminster | Animal Nutrition Conferences | Iowa State University | Victoria University | Leeds Beckett University | York University | Illinois State University | University of New England Maine | Cal Poly Pomona University | University of Central Missouri | University of Arizona | University of Houston | University of Minnesota Twin Cities | Dietetics Conferences | Seoul National University | Gannon University | Liverpool John Moores University | Ohio State University | Florida International University | Shiraz University of Medical Sciences | Cornell University | Public Health Nutrition Conferences | University of Glasgow | University of Reading | University of Arkansas Fayetteville | Madonna University | Henderson State University | University of Prince Edward Island | State University of New York Plattsburgh | Carson-Newman University | Nottingham Trent University | University of Missouri - Columbia | University of Mississippi | Andrews University | The University of Hertfordshire | Molecular Nutrition Conferences | Texas A&M University - Kingsville | University of Arizona | University of British Columbia | Erasmus University College Brussels | Cardiff Metropolitan University | London Metropolitan University | University of Nottingham | Plymouth University | | Food Security Conferences | Cardiff Metropolitan University | Queen Margaret University | Birmingham City University | University of Chester | Nutrition Conferences | Leeds Beckett University | University of Manchester | University of Chester | Ulster University | University of Worcester | Glasgow Caledonian University | Food and Beverage Conferences | University of Stirling | Bangor University | Heriot-Watt University | Oxford Brookes University | University of Westminster | University of Bristol | Loughborough University | King's College | University of Chester | Oxford Brookes University | Food Conferences | University of Glasgow

Universities in Copenhagen

Global Nutrition and Health University of oxford | Copenhagen University | Aarhus University | Technical University of Denmark | University of Hohenheim | Aalborg University

Universities in Denmark

Danish Nutrition Society | International Confederation of Dietetic Associations | Association for Nutrition | Aimed at investigating the associations | Danish Diet & Nutrition Association | The Nutrition Society | Federation of European Nutrition Societies

USA:

University of Alberta | The University of Guelph | University of Saskatchewan | Central Michigan University | McGill University | University of British Columbia | University of Florida | Keiser University | Sports Nutrition Conferences | Miami Dade College | Food Conferences | Hillsborough Community College | Eckerd College | University of North Florida |Nutrification Conferences Florida State College | University of North Alabama | Food Safety Conferences University of Toledo | The University of Pittsburgh | State University of New York College | Animal Nutrition Conferences | University of Illinois | Molecular Nutrition Conferences | Texas State University | San José State University | University of New Hampshire | South Carolina State University | South Carolina | University of Minnesota | Wayne State University | College of Saint Elizabeth | Food Safety Conferences Eastern Oklahoma State College | Animal Nutrition Conferences | University of Arkansas For Medical Sciences | University of the Incarnate Word | McNeese State University | Abilene Christian University | Nutrification Conferences North Dakota State University | Food Conferences | North Dakota | Sports Nutrition Conferences | University of Bridgeport | Nutrition Conferences| George Mason University | University of Alabama at Birmingham | Sacred Heart University | University of Tampa| University At Buffalo | Food Safety Conferences The State University of New York | University of Kentucky | Iowa State University